Gratis helsekurs på nett

Medkurs.no er en norsk nettside som tilbyr gratis helsekurs på nett med mål om å spre helsekunnskap

Nyeste kurs

Årlig Vaksinering av Hund: En Guide for Ansvarlige Eiere

Hvorfor er årlig vaksinering av hund viktig? Vaksinasjon spiller en kritisk rolle i helsen til våre firbente venner. Det beskytter hundene mot alvorlige infeksjoner og

Viktigheten av årlig vaksine for katten din

Hvorfor er en årlig vaksine viktig for katten din? Å vaksinere katten din årlig er avgjørende for å opprettholde dens helse og velvære. Vaksiner hjelper

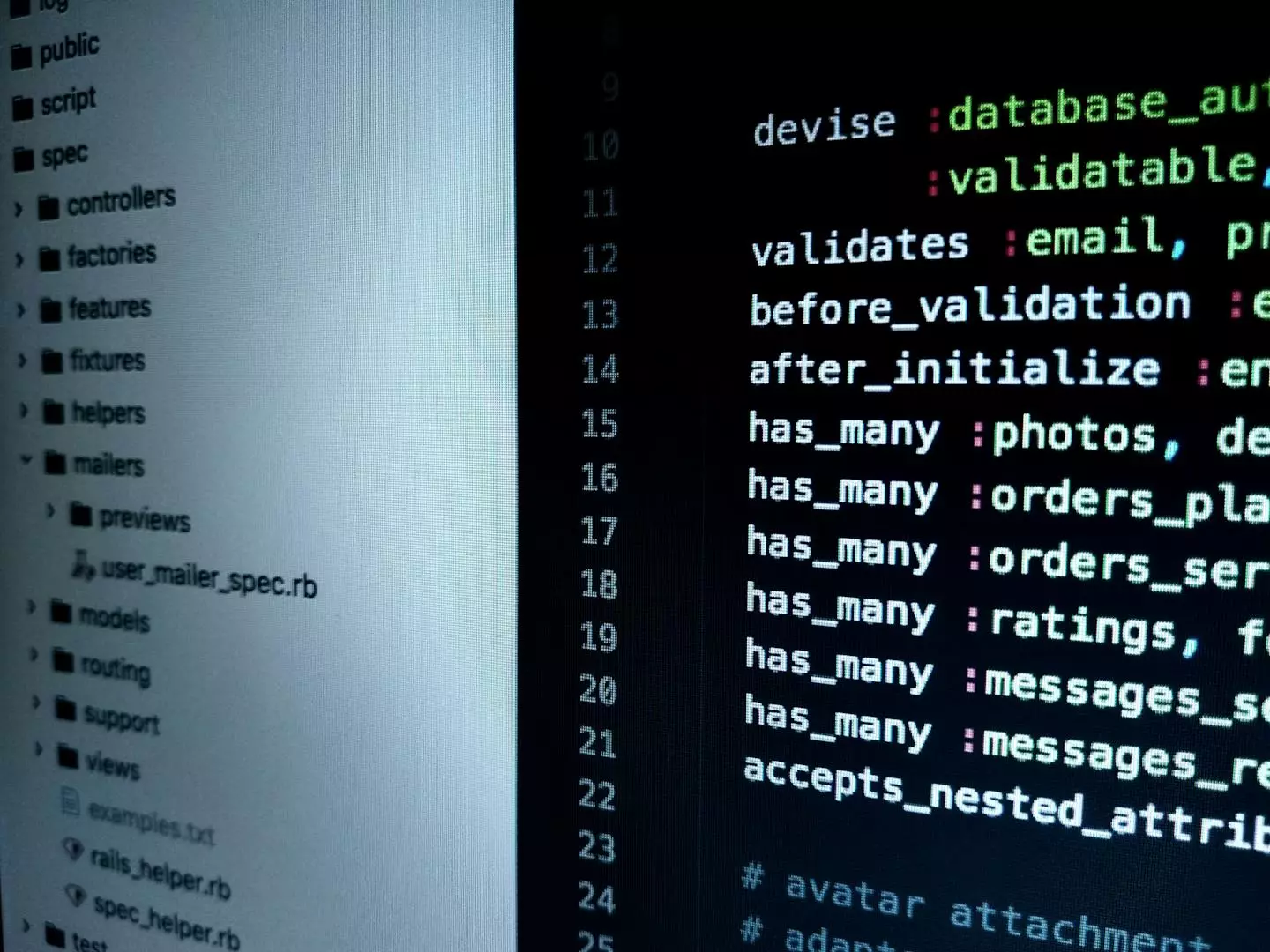

Beskytt deg mot Zeus 2022 Trojan: En omfattende guide

Introduksjon til Zeus 2022 Trojan Zeus Trojan, en kjent skadelig programvarevariant, har vært i omløp i flere år. Forståelsen av hvordan den evolverer og hva

Alt du trenger å vite om Zeus 2022 Virus

Introduksjon til Zeus 2022 Virus Zeus 2022 virus er en ny variant av den kjente Zeus-programvaren, som opprinnelig ble oppdaget for første gang tilbake i

Sikkerhet på Nett: En Grundig Gjennomgang av Zemana Anti Malware

Introduksjon til Zemana Anti Malware Når det kommer til å beskytte din digitale verden, er Zemana-en-omfattende-guide-til-anti-malware-programmer/)/) Anti Malware et navn som ofte kommer opp. I

Sikkerhet på Nett: En Grundig Gjennomgang av Zemana Antivirus

Introduksjon til Zemana Antivirus Zemana Antivirus er en av de mindre kjente, men svært effektive, sikkerhetsløsningene mot skadelig programvare og virus som truer våre digitale

Beskytt Deg Mot Ymacco Trojan: Din Guide for Sikkerhet og Forebygging

Hva er Ymacco Trojan? Ymacco-med-antivirus-trojan-killer/)-ymacco-en-omfattende-guide-til-beskyttelse-og-fjerning/) Trojan er en type skadelig programvare, eller malware, som spesifikt kan infiltrere datamaskiner uten at brukeren er klar over det.

Beskytt Din Datamaskin: Alt du Trenger å Vite om Zemana Anti

Introduksjon til Zemana Anti I den digitale æraen er cybersikkerhet-mot-skadelig-programvare-en-guide-til-anti-mal/) av største betydning. Et av verktøyene som står i frontlinjen i kampen mot cybertrusler er

Beskytt din WordPress-side mot virus

Introduksjon til WordPress og virusfare WordPress er et av verdens mest brukte publiseringsverktøy for nettsider. Dets popularitet og åpen kildekode-natur gjør det til et attraktivt

Utforsk Xhelper: Din Ultimative Guide til Bedre Produktivitet og Effektivitet

Introduksjon til Xhelper Xhelper er et innovative verktøy designet for å booste produktiviteten og effektiviteten i hverdagen din. Enten det dreier seg om arbeid, studier

En Grundig Gjennomgang av Win32 Bladabindi ML: Slik Beskytter du Deg

Introduksjon til Win32 Bladabindi ML Win32 Bladabindi, også kjent som njRAT eller Bladabindi, er en ondsinnet trojaner som hovedsakelig benyttes til å utføre fjernadministrasjon av

Wise Anti Malware: Din Ultimate Beskytter Mot Skadelig Programvare

Introduksjon til Wise Anti Malware Når det gjelder å beskytte datamaskinen din mot malware, virus og andre trusler, er Wise Anti Malware et navn du

Hvordan Bekjempe Virus Spam i Google Chrome Effektivt

Introduksjon til Virus Spam i Google Chrome Virus og spam kan utgjøre alvorlige trusler når du surfer på nettet, spesielt gjennom populære nettlesere som Google

Beskytt PC-en Din: En Guide til Valg og Bruk av Virusprogram

Hva er et virusprogram for PC og hvorfor trenger du det? Et virusprogram for PC, ofte omtalt som antivirusprogram-fra-pc-en-komplett-guide/), er en programvare utviklet for å

Er det virkelig nødvendig med årlig vaksinasjon?

Hva er en årlig vaksine for hund? Årlig vaksinasjon er en kritisk del av forebyggende helseomsorg for hunder. Den beskytter mot flere farlige og potensielt

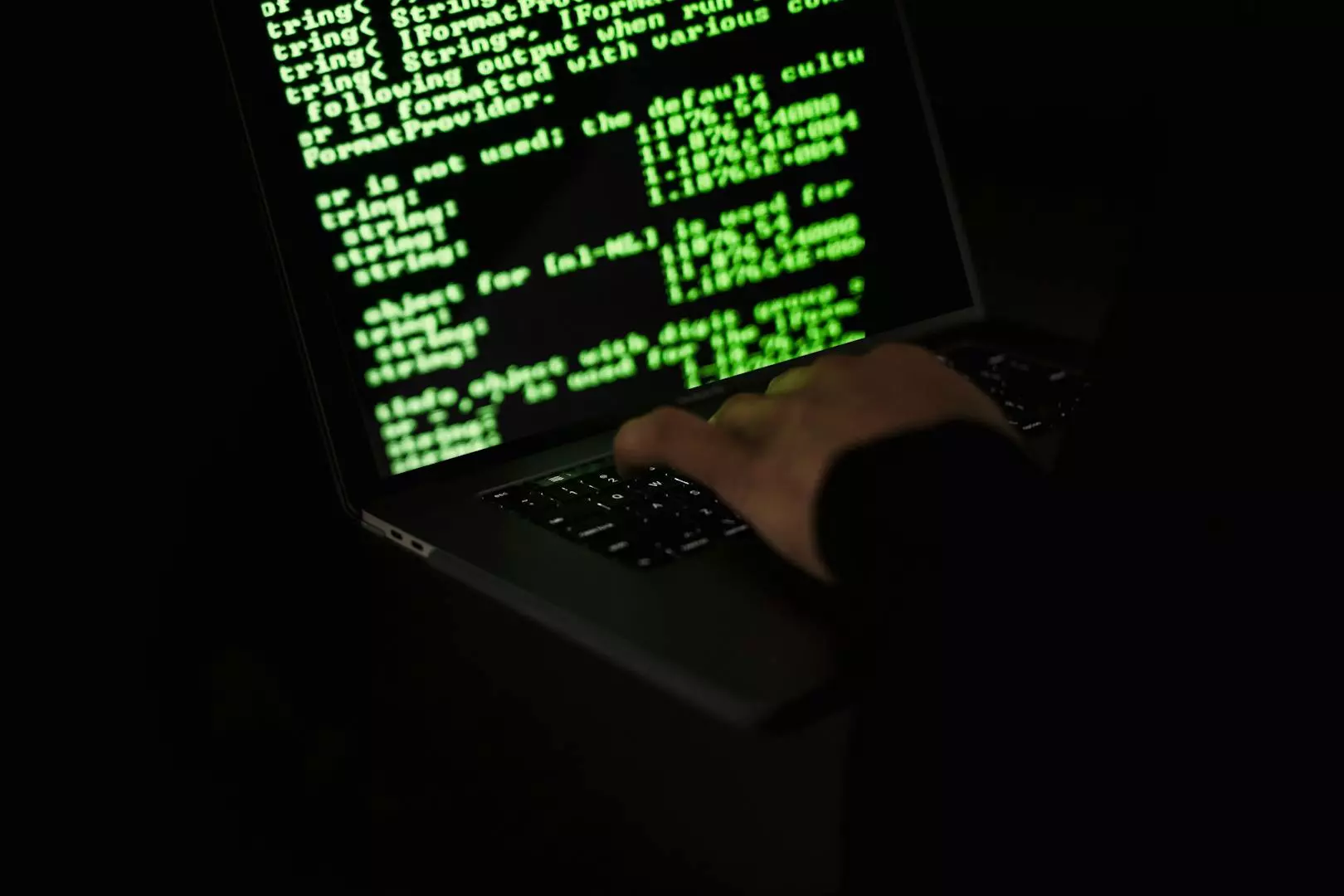

Beskyttelse mot virus på pc: En komplett guide

Hva er et virus på PC, og hvordan kan det påvirke deg? Et virus på en PC er et ondsinnet program designet for å spre

Virus på PC: Hva gjør jeg?

Introduksjon til problemet med virus på PC Når du merker at din PC oppfører seg unormalt – treg operasjon, uventede popup-vinduer eller uforklarlige feilmeldinger –

Guide: Hvordan håndtere virus på Google Chrome

Introduksjon til virus på Google Chrome Google Chrome er verdens mest populære nettleser, takket være dens brukervennlighet og kraftige funksjoner. Dessverre er den også et

Beskytt Deg mot Virus på Datamaskinen: En Omfattende Guide

Introduksjon til Virus på Datamaskin Datavirus kan virkelig være en hodepine. Disse små skadelige programmene har som hensikt å infisere din datamaskin, forstyrre dens normale

**Forstå og Beskytte Deg mot Virus Trojan Zeus 2021**

Introduksjon til Virus Trojan Zeus 2021 Virus Trojan Zeus-zeus/) er en velkjent type malware, spesielt kjent for å stjele finansiell informasjon fra de infiserte datamaskinene.

Guide til å Håndtere Virus Pop-up i Google Chrome

Hvordan identifisere og fjerne Virus Pop-up Chrome Pop-up-varsler i nettlesere kan ofte være nyttige, men noen ganger kan de være en kilde til irritasjon og

Beskytt din PC: Forstå og bekjemp Virus, PC Trojanere

Virus PC Trojan: En Introduksjon I en verden stadig mer avhengig av digital teknologi, er trusselen fra virus og trojaner for PC en økende bekymring.

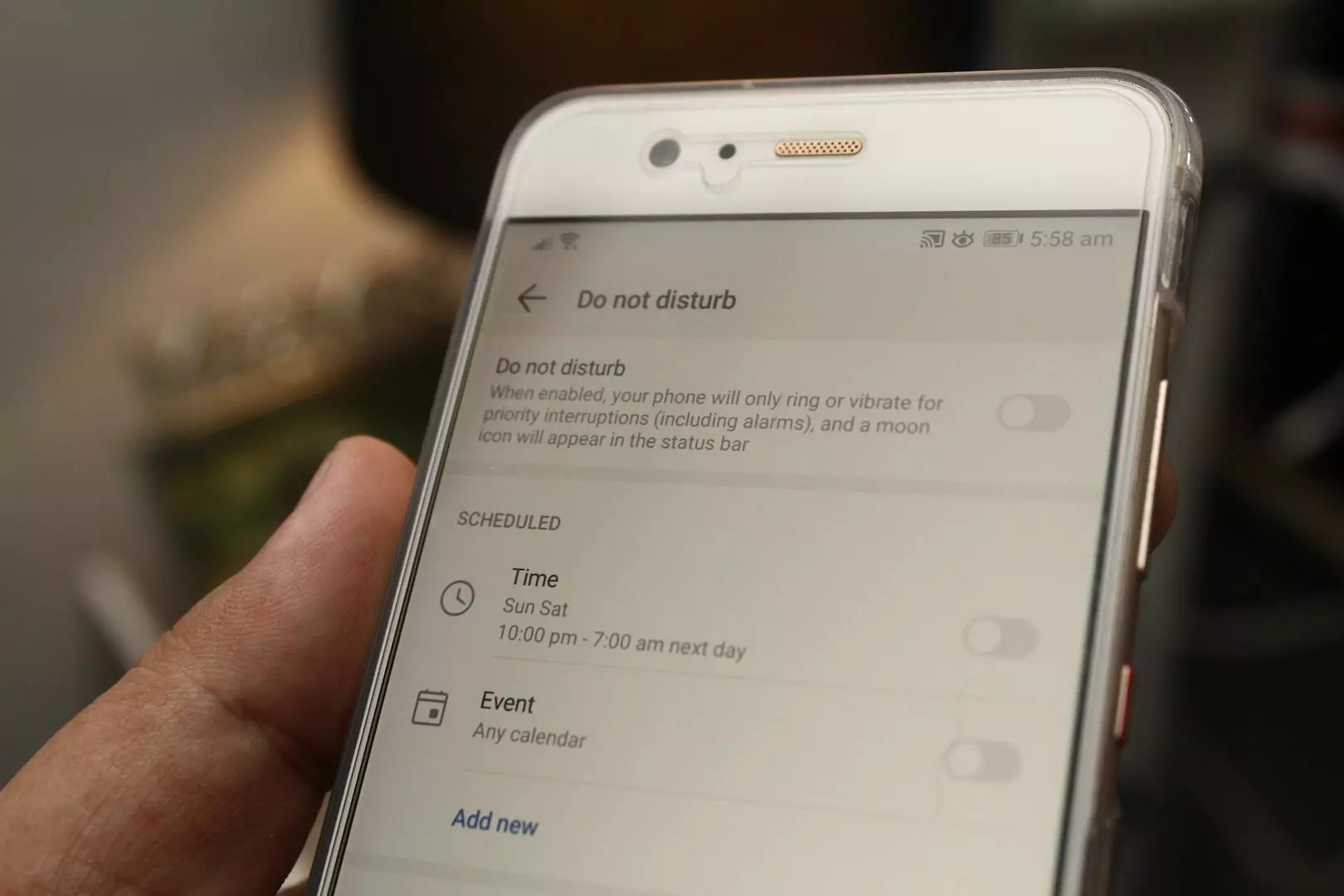

Til kamp mot virus: Sikkerhetsråd for MMS på Android-enheter

Innledning til virusproblemer på Android via MMS Mobiltelefoner har blitt en integrert del av vårt daglige liv, men disse enhetene er også utsatt for sikkerhetstrusler.

Den Ultimative Guiden til Virus Online Scanner Kaspersky

Introduksjon til Virus Online Scanner Kaspersky I en verden hvor internetttrusler stadig vokser, er det viktigere enn noensinne å beskytte seg mot virus og malware.

En Dybdegående Analyse av ‘Zeus 2021 Trojan’: Hvordan Beskytte Deg og Dine Digitale Enheter

Introduksjon til 'Zeus 2021 Trojan' Zeus Trojan, også kjent som Zbot, har vært en kjent trussel mot datasikkerheten siden 2007. Det som gjør den særlig

Alt du trenger å vite om Virus, Malware og Spyware

Virus, Malware, Spyware: Forstå forskjellene Virus, malware-med-anti-malware-losninger/), og spyware er begreper som ofte blir brukt om hverandre, men de refererer til ulike typer skadelig programvare

Alt du trenger å vite om Zbot: En grundig guide

Introduksjon til Zbot Zbot, også kjent som Zeus botnet, har vært et kjent navn i cybersikkerhetsverdenen i flere år. Dette malware-programmet, kjent for sin evne

Virus Google Chrome Android: En komplett guide for beskyttelse og fjerning

Innsikt i Virus Google Chrome Android Virus som påvirker Google Chrome på Android-enheter kan variere i sin natur og skadelighet. Noen er designet for å

Beskytt Din Enheter mot Virus på Google Play

Introduksjon til virus på Google Play Google Play er stedet hvor millioner av Android-brukere finner apper og spill. Dessverre kan det også være et sted

Virus i Google Chrome: Hvordan identifisere og fjerne dem

Innledning til virus i Google Chrome Google Chrome er en av verdens mest brukte nettlesere. Den tilbyr rask tilgang til internett med et brukervennlig grensesnitt.

Effektiv bruk av natron i husholdningen

Hva er natron og hvordan kan det brukes i hjemmet? Natron, også kjent som natriumbikarbonat, er et hvitt krystallinsk pulver som primært brukes i baking.

Beskytt Din Virksomhet: Hvordan Håndtere Virus i Google Ads

Intro til Virus i Google Ads Virus og skadelig programvare kan skape alvorlige problemer for enhver bruker av digitale annonseringstjenester, inkludert Google Ads. Når disse

Fullstendig Guide til VSNTe222: Alt du trenger å vite

Innledning til VSNTe222 VSNTe222 er et tema som har vakt stor interesse blant mange i diverse fagmiljøer, men det kan være vanskelig å finne grundig,

Beskytt din Apple iPhone mot virus: En komplett guide

Innledning: Virus på Apple iPhone Selv om det er mindre vanlig for iPhone-enheter å bli infisert med virus sammenlignet med andre operativsystemer, er det viktig

Vinterlook: Din komplette guide til en stilfull og varm vintersesong

Introduksjon til vinterlook Vinteren kan være både utfordrende og spennende når det gjelder mote. Med kuldegrader som banker på døren, er det essensielt å kle

Utforsk Magien Ved Vegetarmat: En Bloggguide til Nybegynnere og Entusiaster

Velkommen til din nye favoritt vegetarmat blogg! I dagens samfunn vokser interessen for plantebasert kosthold raskere enn noensinne, og det er mange gode grunner til

Hvordan håndtere og forebygge virus på Samsung-enheter

Innledning til virusproblemer på Samsung Virus og skadelig programvare kan være en stor bekymring for alle som eier en smarttelefon, inkludert de med Samsung-enheter. Disse

Beskytt PC-en din mot skadelig programvare med WinZip Malware Protector

Hva er WinZip Malware Protector? WinZip Malware Protector er et sikkerhetsverktøy designet for å beskytte datamaskiner mot malware, spyware og andre skadelige angrep. Dette programmet

Alt du trenger å vite om vaksinering av hund

Hvorfor er vaksinering av hund viktig? Vaksinering av hund er en essensiell del av forebyggende helseomsorg og beskytter din firbente venn mot flere alvorlige og

Viktig Informasjon om Vaksinering av Katt

Hvorfor er vaksinering av katt essensielt? Vaksinering av katt er ikke bare en forebyggende handling mot diverse sykdommer, men det er også et kjærlighetsbevis fra

Alt du trenger å vite om vaksinering av hund

Hvorfor er vaksinering av hund så viktig? Vaksinering av hund er et vesentlig ledd i forebygging av alvorlige sykdommer. Ved å vaksinere din firbente venn,

Beskyttelse mot Win Trojan: En Veiledning til Sikker Digital Praksis

Forståelse av Win Trojan og Dens Innvirkninger Win Trojan er mer enn bare en uønsket programvare; den er en type malware designet for å infiltrere

Alt du trenger å vite om vaksiner til hunden din

Hvorfor er vaksiner viktig for hunder? Vaksinering av hunder er en essensiell del av dyrets helseomsorg. Det sikrer mot alvorlige, potensielt dødelige sykdommer som parvovirus,

Beskytt din MacBook mot virus: En omfattende guide

Er din MacBook sårbar for virus? Tro det eller ei, selv om MacBooks tradisjonelt har vært mindre utsatt for virus sammenlignet med PCer, er de

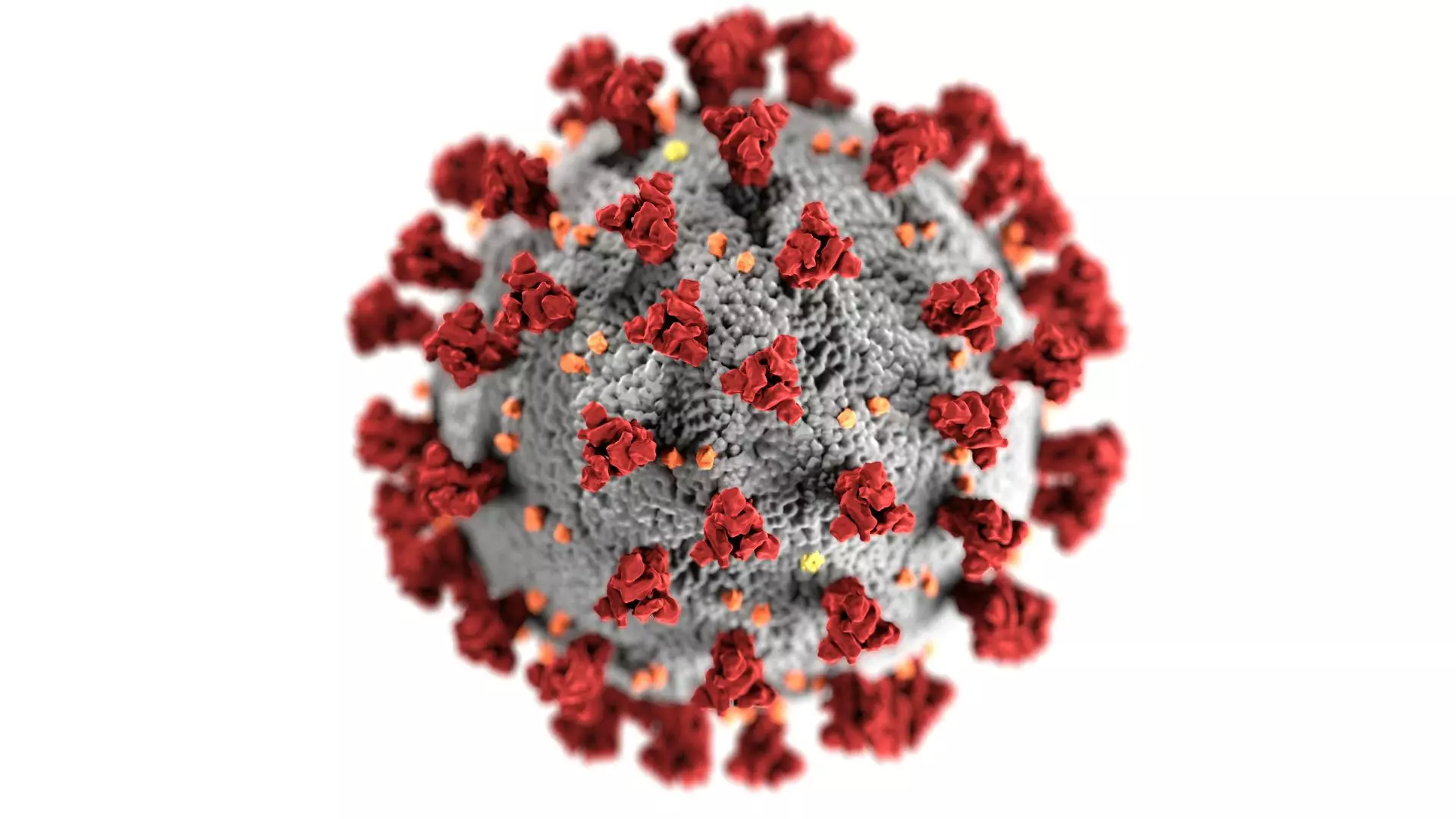

Alt du trenger å vite om Virus Zeus 2022: Beskyttelse og forebygging

Hva er Virus Zeus 2022? Virus Zeus, også kjent som Zbot, har vært en kjent trussel siden den først dukket opp i 2007. Den er

Vaksine Valp Når: En Komplett Guide for Nye Eiere

Introduksjon til Vaksinasjonsplan for Valper Å ta med seg en ny valp hjem er en spennende tid, og i all spenningen ligger det også et

Beskytt Datamaskinen din med XVirus Anti-Malware

XVirus Anti-Malware: Introduksjon I en verden der datakriminalitet stadig vokser, er det avgjørende å beskytte din digitale informasjon. XVirus Anti-Malware er et verktøy designet for

Beskyttelse mot virus på Android-systemet: En omfattende guide

Hva er virus på Android-systemet? Virus i Android-systemet refererer til skadelig programvare som designes for å infiltrere, skade eller stjele informasjon fra din Android-enhet. Disse

Beskytt Din iPhone: En Omfattende Guide til Virus og Malware

Hva er Virus og Malware på iPhone? Virus og malware-med-anti-malware-losninger/) har tradisjonelt vært sett på som problemer primært for PC-er, men med den stadig økende

Viktig Vaksinasjonsveiledning for Din Valp på 16 Uker

Hvorfor er vaksine valp 16 uker essensielt? Valpers immunforsvar er i en fase av rask utvikling når de når 16 uker. Det er derfor denne

Viktigheten av å Vaksinere Dyr: En Omfattende Guide

Hvorfor er det Essensielt å Vaksinere Dyr? Vaksinering av dyr er en fundamental helsepraksis som beskytter kjæledyrene våre mot en rekke alvorlige sykdommer. Ved å

Den essensielle guiden til vaksine til katt

Hvorfor er vaksine til katt viktig? Vaksinering av katter er en fundamental del av forebyggende helsearbeid for dyrene våre. Ved å vaksinere en katt, beskytter

Er Vaksine for Katt Nødvendig? En Veiledende Gjennomgang

Hvorfor er Vaksine Katt Nødvendig? Vaksinering av katter er et viktig steg i omsorgen for våre firbente venner. Det handler ikke bare om å beskytte

Tilrettelegging og informasjon: Vaksine mot rabies for hunder

Hvorfor er vaksine mot rabies viktig for din hund? Rabies er en dødelig virusinfeksjon som primært spres gjennom bitt fra infiserte dyr. Den rammer nervesystemet

Viktigheten av Å Forstå Bivirkninger ved Vaksine for Katter

Innledning til Vaksine Katt Bivirkninger Vaksinering av katter er et essensielt forebyggende tiltak mot flere alvorlige sykdommer. Mens vaksiner generelt er trygge og effektive, kan

Alt du trenger å vite om vaksinering av katter

Hvorfor er det viktig med vaksine for katter? Vaksinasjon er en av de mest effektive metodene for å beskytte kattens helse. Vaksiner hjelper til med

Beskyttelse mot virus på mobile Android-enheter

Hva er virus mobile android? Virus er en type skadelig programvare som kan infisere mobile enheter, inkludert Android-smarttelefoner og -nettbrett. Disse truslene kan variere fra

Forsvare din iPhone mot virus: En Apple-brukers guide

Alt du trenger å vite om virus på iPhone fra Apple Virus på iPhones har blitt et mer omtalt tema i tech-verdenen, mye fordi mange

Vaksinasjon av Katt: En Komplett Guide til Din Furry Venns Helse

Hvorfor er vaksinasjon av katt viktig? Vaksinasjon spiller en kritisk rolle i livet til alle katter, ved å beskytte dem mot alvorlige, potensielt livstruende sykdommer.

Viktigheten av Vaksinasjon av Hund: En Guide til Ansvarlig Hundehold

Hvorfor er vaksinasjon av hund essensielt? Vaksinasjon spiller en avgjørende rolle i helsen til din firbeinte venn. Ved å vaksinere hunder kan vi forebygge alvorlige

Øk Din Utvidede Markedsrekkevidde: Strategier for Enhver Virksomhet

Introduksjon til å utvide markedsrekkevidden I den stadig voksende globale økonomien henger suksessen til en virksomhet tett sammen med dens evne til å nå nye

Alt du trenger å vite om UDS Trojan

Introduksjon til UDS Trojan UDS Trojan regnes blant de mer skadelige formene for malware som treffer cyberspace. Denne typen trojaner kan gi cyberkriminelle uautorisert tilgang

Tyrkisk Mat Blogg: En Reise gjennom Tyrkias Kulinariske Landskap

Introduksjon til Tyrkisk Mat Blogg Velkommen til denne oppslukende reisen der vi utforsker tyrkisk matkultur gjennom tradisjonelle oppskrifter, lokale hemmeligheter, og personlige historier. Tyrkisk mat

Trojan Zeus 2021: Alt du trenger å vite

Innledning: Forstå viktigheten av å kjenne til Trojan Zeus 2021 Trojan Zeus, også kjent som Zbot, har vært et kjent navn i verden av cybersikkerhet

Alt du trenger å vite om å vaksinere katten din: Priser og anbefalinger

Vaksinere katt pris: Hvor mye koster det egentlig? Prisen på å vaksinere en katt kan variere avhengig av flere faktorer, inkludert geografisk beliggenhet, type vaksine,

Trojan Ymacco: En Omfattende Guide til Beskyttelse og Fjerning

Hva er Trojan Ymacco? Trojan Ymacco er et ondsinnet program-programmene-i-2023/) som klassifiseres som en trojansk hest. Denne type malware er designet for å snike seg

Vegghengt toalett lekker: Slik løser du problemet

Introduksjon til vegghengte toaletter som lekker Vegghengte toaletter er blitt svært populære i moderne hjem på grunn av deres plassbesparende design og elegante utseende. Dessverre

Trojan Win32/Ymacco: Din Guide til Beskyttelse og Fjerning

Introduksjon til Trojan Win32/Ymacco Trojan Win32/Ymacco er en ondsinnet programvare som har vært aktiv de siste årene. Denne trojaneren truer individers og bedrifters datasikkerhet ved

Trojan Win32: Forstå og Bekjempe Dataviruset

Introduksjon til Trojan Win32 Trojan Win32 representerer en kategori av skadelig programvare (malware) som kan skape enorme problemer for både individuelle brukere og virksomheter. Dette

Viktigheten av Vaksinering for Valpen din Ved 12 Uker

Introduksjon til Vaksine for Valp på 12 Uker Når hunden din nærmer seg 12-ukers alderen, nærmer det seg tid for en viktig milepæl i dens

Trojan Remover: Hvordan Beskytte Datamaskinen Effektivt

Introduksjon til Trojan Remover Trojanske hester, ofte bare kalt trojanere, er en type ondsinnet programvare designet for å se ut som legitim programvare. Disse skadelige

En Grundig Gjennomgang av Trojan njRAT: Hva Du Trenger å Vite

Introduksjon til Trojan njRAT Trojan njRAT, også kjent som Bladabindi, er en av de mest beryktede trojaner som brukes for cyberangrep siden rundt 2013. Det

Viktigheten av Vaksiner til Hund: En Omfattende Guide

Introduksjon til Vaksiner til Hund Å vaksinere hunden din er et kritisk skritt i å sikre dens langvarige helse og velvære. Vaksinasjon hjelper til med

Alt du trenger å vite om Trojan Multi GenAutorunReg A Kaspersky

Introduksjon til Trojan Multi GenAutorunReg A Kaspersky I den digitale tidsalder vi lever i, blir datasikkerhet stadig viktigere. En av truslene som brukere ofte møter,

Alt du trenger å vite om Vaksine for Hund når den er 1 år

Introduksjon til vaksinering av hund når den er 1 år Når du har en firbeint venn som nærmer seg sitt første år, er det av

Trojan McAfee: En omfattende guide for å beskytte din digitale verden

Forstå Trojan McAfee: Hva er det egentlig? Trojanere, ofte kjent som trojanske hester, er en type skadelig programvare designet for å fremstå som legitime programmer.

Trojan Win32 Dridex ML – En Trussel mot Digital Sikkerhet

Introduksjon til Trojan Win32 Dridex ML Trojan Win32 Dridex ML er et avansert eksempel på skadelig programvare som primært rammer Windows-brukere. Denne trojaneren, kjent for

Trojan Malware 300983: En Omfattende Veiledning

Innledning til Trojan Malware 300983 Trojan malware-en-guide-til-anti-mal/) 300983 representerer en alvorlig trussel mot datasikkerheten. I denne artikkelen vil du lære hvordan denne typen skadelig programvare

Beskyttelse mot Trojan Kryptik: En omfattende veiledning

Innføring i Trojan Kryptik Trojan/) Kryptik er en malwaretype som ofte skjuler seg i tilsynelatende uskyldige programmer eller filer for så å utføre skadelige handlinger

Trojan Killer: Din Ultimate Guide til Beskyttelse og Sikkerhet

Hva er en Trojan Killer? En trojan killer er et dedikert program designet for å oppdage og eliminere trojanere fra dine enheter. Trojanere, en type

Viktig Informasjon om Vaksine for Valper ved 8 Uker

Vaksinering av valper ved 8 uker: En essensiell guide Vaksiner spiller en kritisk rolle i helsen til din valp. De bidrar til å beskytte unge

Alt du Trenger å Vite om Trojan Downloader: En Omfattende Guide

Hva er en Trojan Downloader? Trojan downloader er en type ondsinnet programvare (malware) som er designet for å laste ned og installere ytterligere skadelig programvare

Vaksinasjonsplan for din Valp – Nødvendig Beskyttelse fra Start

Hvorfor er Vaksine Valp så viktig? Vaksinasjon av valper er en kritisk del av deres helseomsorg og sørger for et langt og friskt liv. Disse

Alt du Trenger å Vite om Trojan Download Virus

Innsikt i Trojan Download Virus: En Grundig Analyse Trojan download virus er en type malware som ofte blir oversett til det er for sent. Dette

Beskytt deg mot Trojan Gen2: En omfattende veiledning

Introduksjon til Trojan Gen2 Trojan Gen2 er en ny og forbedret versjon av det tradisjonelle trojanviruset som truer digital sikkerhet verden over. Denne typen malware

Beskyttelse mot UEFI Virus: Forstå Trusselen og Hvordan Sikre Systemet Ditt

Introduksjon til UEFI Virus UEFI (Unified Extensible Firmware Interface) gir en moderne tilnærming til hvordan operativsystemer og firmware kommuniserer med hverandre. Men slik avansert teknologi

Beskytt deg mot Trickbot: Din Komplette Guide

Hva er Trickbot? Trickbot-trickbot-en-grundig-veiledning/) er en type ondsinnet programvare (malware) som opprinnelig dukket opp i 2016. Opprinnelig utviklet som en banktrojaner, har Trickbot utviklet seg

Beskytt PC-en mot trojanere med Windows Defender

Innføring i Trojan Windows Defender Trojanere er en type ondsinnet programvare (malware) designet for å infiltrere din datamaskin uten din viten. En av de beste

Beskytt Android-enheten din mot Triada-viruset

Introduksjon til Triada-virus på Android Det er mange ytre farer som truer sikkerheten til våre mobile enheter. Blant disse sikkerhetstruslene står Triada-viruset ut som særlig

Er online antivirus like effektivt som tradisjonelle løsninger?

Hva Er Total Antivirus Online? Total Antivirus-download-din-guideline-til-sikker-nettbruk/) Online representerer en komplett løsning for å beskytte dine digitale enheter mot virus, malware, og andre sikkerhetstrusler som

Utforsk Kjøkkengleder med Toms Matprat Blogg

Introduksjon til Toms Matprat Blogg Velkommen til en verden av kulinariske eventyr på Toms Matprat Blogg! Her får du en enestående mulighet til å dykke

Hvordan Beskytte Deg mot Trojan Win64: En Omfattende Guide

Introduksjon til Trojan Win64 Trojan Win64 refererer til en kategori av ondsinnede programvarer (malware) som er designet for å skjule seg som lovlige programmer på

Trojan Zeus: Hvordan Beskytte Deg mot Denne Ondsinnete Skadelige Programvaren

Innledning til Trojan Zeus Trojan Zeus, også kjent som Zbot, er en type trojansk hest-skadelig programvare som primært brukes til å stjele sensitiv finansiell informasjon.

Tips for å Fikse et Toalett som Lekker

Introduksjon til Problemet med Et Toalett som Lekker Å oppdage at toalettet-en-komplett-guide-til-a-lose-problemet/) lekker kan være både irriterende og kostbart over tid. Ikke bare kan det

Toalett Sisterne Lekker: En Praktisk Guide for Håndtering og Reparasjon

Introduksjon til problemet med en lekker toalett sisterne Når du oppdager at toalettsisternen din lekker-som-lekker/), kan det virke som en mindre irritasjon, men det kan

Toalett lekker gulv: En guide til løsninger og forebygging

Årsaker og umiddelbare tiltak når toalettet lekker på gulvet Når du oppdager at toalettet-en-komplett-guide-til-a-lose-problemet/) lekker ut på gulvet, kan dette ikke bare føre til ulemper,

Telenor Ruter Kobling: En Trinnvis Guide

Introduksjon til Kobling av Telenor Ruter Å koble til en Telenor ruter kan virke komplisert ved første øyekast. Men med riktig veiledning, skal du se

Beskytt Deg mot Trojan W32: En Grundig Guide

Introduksjon til Trojan W32 Trojan W32 er en type skadelig programvare (malware) som ofte infiltrerer datasystemer forkledd som et legitimt program. Dette gjør det spesielt

Telenor Koble til Internett: En Enkel Guide for Alle Hjem

Introduksjon til Telenor Koble til Internett I en verden hvor internettforbindelsen er blitt like essensielt som strøm og vann, er det viktig å kunne koble

T95 Malware: En Omfattende Guide til Forståelse og Beskyttelse

Introduksjon til T95 Malware T95 malware-en-guide-til-anti-mal/) har vokst frem som en betydelig trussel mot datasikkerheten globalt. Denne typen skadelig programvare kan infiltrere systemer ubemerket, og

Hvordan Sjekke og Beskytte ditt Nettverk mot VPNFilter Malware med Symantec

Introduksjon til Symantec VPNFilter Check I en verden hvor internett-sikkerhet blir stadig mer kritisk, har trusler som VPNFilter malware fått økt oppmerksomhet. Dette ondsinnede programmet

Trojan Chrome: Hvordan Beskytte Deg mot Skjulte Trusler i Nettleseren Din

Innledning til 'Trojan Chrome' Cybersikkerhet er mer kritisk enn noensinne når vi stadig flytter flere av våre daglige aktiviteter til nettet. Et økende problem som

Sikre Nettstedet ditt med Sucuri SiteCheck Scanner

Hva er Sucuri SiteCheck Scanner, og hvorfor er den viktig? Sucuri/) SiteCheck Scanner er et viktig verktøy for alle som eier eller forvalter en nettside.

Sikre Nettstedet Ditt med Sucuri SiteCheck

Hva er Sucuri SiteCheck? Sucuri SiteCheck er et populært verktøy designet for å skanne nettsteder for sikkerhetstrusler som malware, svartelisting, nettstedfeil og andre sikkerhetsrisikoer. Ved

Beskytt Din PC mot Spyware

Introduksjon til Spyware på PC Spyware er en type skadelig programvare som infiserer din datamaskin for å samle inn personlige opplysninger uten din tillatelse. Formålet

Tinas Mat Blogg: En Guide til Hjemmelaget Lykke

Utforsk deilige oppskrifter på Tinas Mat Blogg Tinas Mat Blogg har raskt blitt et favorittsted for matentusiaster som er på jakt etter inspirasjon til både

Utforsk Verdenen av Tesla og Trojanske Virus

Introduksjon til Trojan Tesla Trojan Tesla er ikke bare et søkeord, men en sammensmelting av to viktige temaer: cybersecurity og revolusjonerende bilteknologi. I denne artikkelen

Trojan Killer Portable: Din Uunnværlige Sikkerhetsverktøy på Farten

Introduksjon til Trojan Killer Portable I en verden hvor nett-trusler stadig blir mer komplekse, har behovet for robuste sikkerhetsløsninger aldri vært viktigere. Trojan Killer-med-antivirus-trojan-killer/) Portable

Trojan Dridex: En Omfattende Guide til Beskyttelse og Forståelse

Hva er Trojan Dridex? Trojan Dridex er en type skadelig programvare (malware) som primært brukes til å stjele bankinformasjon og andre sensitive data fra intetanende

Beskytt PC-en Din Uten Kostnad: Din Ultimative Guide til Software Anti Malware Gratis

Introduksjon til Software Anti Malware Gratis I en verden hvor digital sikkerhet blir stadig mer sentral, er betydningen av robust anti-programmer/)-malware software uomtvistelig. Men ikke

Guide til hvordan koble Smart TV til Internett

Intro til å koble Smart TV til internett I en verden hvor streamingtjenester som Netflix, Hulu og YouTube dominerer medieforbruket, er en Smart TV nesten

Toalettet lekker – En komplett guide til å løse problemet

Innledning til problemet med lekkasje fra toalettet Hvis du noen gang har opplevd at toalettet lekker, vet du hvor frustrerende det kan være. Ikke bare

Trenger denne appen virkelig tilgang til mine kontakter eller mine meldinger?

Hva er et Spam Virus på Android? Spamvirus er skadelige programmer designet for å infisere mobiltelefoner, spesielt de som kjører Android-operativsystemet. Disse virusene kan komme

Beskytt Din PC: Alt om Å Skanne for Virus og Holde Systemet Sikkert

Innledning til Virus Skanning på PC I en verden hvor digitale trusler stadig vokser, er det kritisk å holde PC-en trygg. Virus, malware, og andre

En Omfattende Guide til Å Beskytte Din Android-Enhet Mot Virus

Intro: Hvorfor en Virus Scanner er Nødvendig for Din Android Å beskytte din Android-enhet mot virus er mer kritisk nå enn noensinne. Med stadig utviklende

Beskytt Nettstedet Ditt Mot Skadeprogrammer: En Omfattende Guide

Hva er Site Malware og hvorfor er det viktig å være oppmerksom? Site malware-en-guide-til-anti-mal/), også ofte kalt nettsteds-skadelig programvare, refererer til ondsinnede koder som er

Scanner Malware Online: Din Guide til Sikkerhet På Nett

Hva er Scanner Malware Online? I en tid der digital sikkerhet stadig tester nye grenser, er det essensielt å holde seg oppdatert om de ulike

Sophos Anti Rootkit: En Omfattende Guide til Sikkerhet og Beskyttelse

Introduksjon til Sophos Anti Rootkit Rootkits representerer en av de mest sofistikerte og vanskelige truslene i cybersikkerhetsverdenen. De er designet for å skjule seg i

Effektive Måter å Skanne etter Virus Online: En Guide

Introduksjon til Skanning av Virus Online I denne digitale æraen er det å ivareta cybersikkerheten viktigere enn noen gang. Med stadige trusler om malware, ransomware

Guide til Å Bruke Scan Virus Site Effektivt

Introduksjon til Scan Virus Site Å forstå hvordan man beskytter sin digitale nærhet kan være utfordrende. Men, med verktøy som Scan-web-slik-beskytter-du-deg-mot-skadelig-programvare-pa-nettet/) Virus Site, blir det

Telia Modem Oppkobling: En Enkel Veiledning For å Komme i Gang

Introduksjon til Telia Modem Oppkobling Når du har valgt Telia som din internettleverandør, er neste skritt å sette opp forbindelsen. Det kan virke litt overveldende

En Fullstendig Guide til Simple Malware Protector: Sikkerhetsvakt for Ditt Digitale Liv

Introduksjon til Simple Malware Protector I en verden full av digital innovasjon og endeløse muligheter, henger dessverre også de uønskede truslene med. Malware kan snike

Scan Virus Web: Slik Beskytter Du Deg mot Skadelig Programvare på Nettet

Introduksjon til Scan Virus Web I en verden der digital sikkerhet blir stadig mer kritisk, er det viktig å være bevæpnet med kunnskap og verktøy

Guide: Slik kan du scanne etter virus i WordPress

Introduksjon til å scanne etter virus i WordPress WordPress er en av verdens mest populære plattformer for å bygge nettsider, men populariteten gjør den også

Hva er et Rootkit? En dypdykkende forklaring

Hva er et Rootkit? Et rootkit er en type skadelig programvare (malware) som gir angriperen administratorrettigheter til et datasystem uten at det oppdages av systemets

Unngå Fellen: Hvordan Identifisere og Beskytte Deg mot Rogue Anti-Spyware

Hva er Rogue Anti-Spyware? Rogue anti-spyware er skadelig programvare forkledd som legitim sikkerhetsprogramvare. Den lokker brukere med falske advarsler om virus og trusler. Målet? Å

Scan Trojan Malware: En Komplett Guide for Beskyttelse og Oppdagelse

Introduksjon til Scan Trojan Malware Trojan malware-en-guide-til-anti-mal/) representerer en av de mest bedrageriske typene av skadelig programvare som infiltrerer datamaskiner og andre enheter mens det

En Grundig Guide til Rootkit og Bootkit: Hvordan Beskytte Din Datamaskin

Introduksjon til Rootkit og Bootkit For både nybegynnere og erfarne databrukere, begreper som rootkit og bootkit kan høres kompliserte og tekniske ut. Men forståelsen av

Guide: Slik Kobler du RiksTV til Internett

Introduksjon til å koble RiksTV til internett Lurer du på hvordan du kan få RiksTV-en-trinnvis-veiledning/) tilkoblet til internett for en bedre opplevelse av TV-titting? I

Guide til å Bruke Scan Trojan Online Effektivt

Introduksjon til 'Scan Trojan Online' Når det kommer til datasikkerhet, er trusselen fra trojanere, som opererer i skjul for å stjele eller skade data, en

Beskytt Deg mot Remote Malware: En Komplett Guide

Introduksjon til Remote Malware Remote malware-en-guide-til-anti-mal/), eller fjernstyrt skadelig programvare, utgjør en alvorlig trussel mot både individuelle brukere og bedrifter. Denne typen malware kan infiltrere

Den Ultimative Guiden til Reise Blogging

Introduksjon til Reise Blogging Reise blogging har blitt et populært fenomen der entusiaster deler sine erfaringer, tips og inspirasjon med et globalt publikum. Hvis du

Scan Malware WordPress Online: En Guide til Økt Nettsikkerhet

Introduksjon til malware-skanning av WordPress-sider online WordPress er en av de mest populære plattformene for å bygge nettsted, men populariteten gjør den også til et

Beskytt Din PC mot Skjulte Trusler: Rootkit Kaspersky Utdypning

Forstå hva en rootkit er og hvordan Rootkit Kaspersky kan hjelpe Rootkits er en type skadelig programvare (malware) designet for å skjule seg dypt innenfor

Alt du Trenger å Vite om Ransomware Makro

Hva er Ransomware Makro? Ransomware makro refererer til et type ondsinnet programvare (malware) som ofte sprer seg gjennom makroer i dokumenter. Disse dokumentene kan se

Guide til Å Scan Trojans: Beskytt Din Datamaskin Effektivt

Hva er en Trojan og Hvordan Kan du Scan Trojan for Bedre Sikkerhet? Trojanere, eller trojan viruses, er en av de mest beryktede mønstrene av

Alt du trenger å vite om Quttera Virus

Hva er Quttera Virus? Quttera Virus er en type malware som kan infisere din datamaskin og utsette personlig informasjon for risiko. Dette skadelige programmet kan

De Beste Gratis Anti-Malware Programmene i 2023

Introduksjon til Program Anti Malware Free I en verden hvor cybertrusler stadig blir mer avanserte, er det helt essensielt å beskytte dine digitale enheter. Gratis

Alt du trenger å vite om private helseforetak

Hva er private helseforetak? Private helseforetak representerer en viktig del av helsevesenet i Norge. Disse institusjonene drives vanligvis av private aktører og tilbyr tjenester som

Deilige Hjemmelagede Rundstykker fra Trines Blogg

Bak med Suksess: Lær å Lage Rundstykker à la Trines Blogg I denne veiledende artikkelen vil vi utforske hemmelighetene bak å lage perfekte rundstykker, slik

Alt du trenger å vite om Privat Helseforetak

Introduksjon til Privat Helseforetak Privat helseforetak, i mange deler av verden, representerer en viktig del av helsesystemet. Disse institusjonene kan variere fra små klinikker til

En Grundig Gjennomgang av Posten Fraktkostnader

Hva bestemmer Posten Fraktkostnader? For å forstå hvordan fraktkostnadene hos Posten beregnes, er det nødvendig å kjenne til flere faktorer. Størrelsen, vekten og destinasjonen for

Alt du Trenger å Vite om Posten Frakt Kostnad

Introduksjon til Posten Frakt Kostnad Når man snakker om å sende pakker, er en av de mest vanlige bekymringene knyttet til kostnadene. I denne veiledningen

Reduserte Fraktkostnader: Effektive Strategier for Din Bedrift

Innledning til Reduserte Fraktkostnader I en verden der effektivitet og kostnadskutt stadig blir mer viktig for bedrifters overlevelse og vekst, står reduserte fraktkostnader sentralt. Fraktkostnader

Komplett Guide til PC-hjelp: Fra Grunnleggende Problemløsing til Eksperttips

Hva er PC-hjelp og hvorfor er det viktig? PC-hjelp refererer til assistansen som gis til brukere som opplever problemer med deres datamaskiner. Dette kan omfatte

Effektive Strategier for Risikoreduserende Tiltak

Introduksjon til Risikoreduserende Tiltak Risiko er en del av hverdagen, enten det gjelder vårt personlige liv, i næringslivet eller innenfor offentlig forvaltning. Å identifisere, analysere

Beskyttelse Mot PC Virus: En Grundig Guide

Hva er en PC virus? PC-virus er små programvarer designet for å spre seg fra en computer til en annen. Disse skadelige kodene kan infiltrere

Rense PC for Virus: En Komplett Guide

Innledning Et virus kan ha katastrofale effekter på din personlige datamaskin. Det kan slette filer, stjele personlig informasjon og i verste fall gjøre hele systemet

Effektiv PC Hjelp i Torvbyen: Din Guide til Problemløsning

PC Hjelp Torvbyen: Hvor Begynner Jeg? Når du møter utfordringer med din datamaskin, er det første steget å identifisere problemet. Er det relatert til maskinvare,

PC Hjelp på Nett: En Komplett Guide til Å Fikse Vanlige Problemer

Introduksjon til PC Hjelp på Nett I vår digitale tidsalder støter mange av oss på tekniske hindringer som kan virke overveldende. Enten det er snakk

Guide til PC Hjelp Pris: Hva kan du forvente å betale?

Innledning til PC-hjelp og prisoverveielser Når teknologien svikter, kan det være kritisk å få rask og effektiv hjelp. Men hva koster egentlig profesjonell PC-hjelp? Prisene

Alt du trenger å vite om rabies vaksine for din valp

Innledning til rabies vaksine for valper Rabies er en dødelig virusinfeksjon som påvirker nervesystemet hos pattedyr, inkludert hunder. For å beskytte din kjære valp mot

En omfattende guide til PC Tools Antivirus Free

Introduksjon til PC Tools Antivirus Free Med økende bekymringer rundt datasikkerhet, er det essensielt å ha et robust antivirusprogram installert på datamaskinen din. PC Tools

Optimalisert Lagerstyring: Hvordan Øke Effektiviteten i Ditt Lager

Introduksjon til Optimalisert Lagerstyring Å ha kontroll på lagerholdningen er essensielt for enhver virksomhet, stor som liten. Uten en effektiv lagerstyringsprosess kan bedrifter støte på

Beskyttelse mot Oodrampi Malware: En Komplett Guide

Hva er Oodrampi Malware? Oodrampi malware er en type skadelig programvare som kan infisere datamaskiner og andre enheter, og dermed utgjøre en alvorlig risiko for

Guide: Slik kobler du Pinell Supersound II til internett

Introduksjon til Pinell Supersound II og internett-tilkobling Pinell Supersound II er en populær radio som ikke bare tilbyr DAB og FM-mottak, men også funksjonalitet for

Beskytt iPhone Mot njRAT Virus: En Grundig Guide

Innledning til njRAT Virus og iPhone Sikkerhet I digitale tider med økende cybertrusler er det essensielt å holde enhetene sikre, spesielt våre smarttelefoner som inneholder

PC Hjelp Hjemme: En Guide til Å Løse Dataproblemer Effektivt

Introduksjon til PC Hjelp Hjemme I en verden der teknologi er en integrert del av hverdagen, kan problemer med PC-en være både frustrerende og tidkrevende.

Effektiv Multivarehusadministrasjon: En Veiledning til Forbedret Lagerstyring

Introduksjon til Multivarehusadministrasjon Multivarehusadministrasjon innebærer management av flere varelager, hvor hver del opererer under varierte forhold og, ofte, med ulike produkttyper. Dette komplekse systemet krever

Moteriktig Vinterlook: Slik Kler Du Deg Stilig og Varmt i Kulden

Lag en moteriktig vinterlook i 2023 Når kulden setter inn, er det ikke bare viktig å holde seg varm; det er også en perfekt anledning

Utforsk Sikkerheten i Microsoft Virus Defender: Din Ultimate Guide

Intro til Microsoft Virus Defender I dagens digitale æra er det essensielt å beskytte våre elektroniske enheter mot skadelig programvare og virus. Microsoft Virus Defender

Guide: Slik Kan Du Oppusse Baderommet Ditt – Trinn for Trinn

Planlegging – Startfasen Når Du Skal Oppusse Baderommet Før du går i gang med å oppusse baderommet, er det essensielt å sette en solid plan.

Komplett Guide til njRAT Download: Sikkerhetsmessige Overveielser og Alternativer

Introduksjon til njRAT Download njRAT, også kjent som Bladabindi, er et eksternt administrasjonsverktøy (RAT) som ofte blir assosiert med skadelig programvare og brukes av hackere

Alt du trenger å vite om Memz Trojan

Introduksjon til Memz Trojan Memz Trojan er en type skadelig programvare som har blitt berømt for sin evne til å skape kaos på infiserte datamaskiner.

PC Hjelp Elkjøp: Din Ultimate Guide til Teknisk Støtte!

Innledning til PC Hjelp hos Elkjøp Når teknologien svikter, kan det være frustrerende, spesielt hvis man står midt i viktige arbeidsoppgaver eller prøver å koble

Mattradisjoner i Norge: Historie, Variasjon og Moderne Trender

Mattradisjoner i Norge: En Historisk Reise Norges mattradisjoner strekker seg langt tilbake i tid. På grunn av landets geografiske forhold og klima har kostholdet tradisjonelt

Mattradisjoner i Europa: En Kulinarisk Reise Gjennom Kontinentet

Oversikt over mattradisjoner i Europa Europa er et kontinent rikt på kultur, historie og selvfølgelig gastronomi. Fra de raffinerte franske rettene til de robuste smakene

Mattradisjoner i Amerika: En Kulinarisk Reise gjennom USA

Introduksjon til mattradisjoner i Amerika Amerikanske mattradisjoner er like varierte som landet selv. Fra de dampende gumbo-pottene i Louisiana til de sprøtt tilberedte clam chowders

Ultimat Guide til PC Hjelp: Løs dine Dataproblemer Enkelt

Introduksjon til PC Hjelp Å stå overfor tekniske problemer med din PC kan være frustrerende. Enten det gjelder treg ytelse, virusinfeksjoner, softwareproblemer, eller hardwarefeil, finnes

Alt du trenger å vite om Malwarex og Hvordan Beskytte Deg

Introduksjon til Malwarex Malwarex er ikke et spesifikt datavirus, men heller et fiktivt navn som kan brukes for å representere forskjellige typer skadelig programvare. Skadelig

Mattradisjoner i Vietnam

Introduksjon til mattradisjoner i Vietnam Vietnam, kjent for sine levende kulturer og storslåtte landskap, har en rik og mangfoldig gastronomisk arv. De lokale mattradisjonene er

Viktige Malwaretips: Slik Beskytter Du Deg mot Skadelig Programvare

Innledning til Malware og Grunnleggende Malwaretips I en verden hvor digital sikkerhet blir stadig mer kritisk, er kunnskap om malware (skadelig programvare) vesentlig for å

Guide til Beskyttelse Mot Notebook Virus

Introduksjon til Problemstillingen: Notebook Virus Dataverdenen er i stadig utvikling. Sammen med denne teknologiske fremgangen, vokser også antall trusler. En slik trussel er notebook virus.

Optimal Sikkerhet med Malwarebytes Gratis for Android

Introduksjon til Malwarebytes Gratis Android I en verden hvor våre mobile enheter stadig er koblet til internett, er trusselen fra skadelig programvare, også kjent som

En komplett guide til Malwarebytes Anti-Malware Free for Windows 10

Introduksjon til Malwarebytes Anti-Malware Free for Windows 10 Malwarebytes Anti-Malware (MBAM) er et kraftig antivirusprogram som tilbyr omfattende beskyttelse mot ulike typer malware, inkludert virus,

Sikre Din Digitale Sikkerhet med Effektiv Malwarecleaner

Introduksjon til Malwarecleaner I dagens digitaliserte verden har et økende antall mennesker blitt avhengige av internett for både personlig og profesjonell bruk. Denne økende avhengigheten

Oppskrifter og Tips for Å Møte Alle Munnene: Din Ultimate Guide til ‘Mat til Familien Blogg’

Innledning: Hvorfor 'Mat til Familien Blogg' Er Din Nye Beste Venn Å planlegge måltider for en familie kan være en utfordrende oppgave. Fra å balansere

Utforsk Verdenen av Mat gjennom en Matblogg

Hva er en Matblogg og Hvorfor Bør Du Følge én? En matblogg er en digital plattform der skribenter deler deres lidenskap for matlaging, matkultur og

Komplette Guide for Malwarebytes Download: Sikker og Enkel Installering

Hva er Malwarebytes? Malwarebytes er et høyt rangert sikkerhetsprogram-portable-din-guide-for-sikker-baerbare-beskyttelse/) designet for å beskytte datamaskiner og mobile enheter mot ulike typer malware, inkludert virus, trojanere, spyware,

Beskytt Datamaskinen din med Malwarebytes

Hvordan Malwarebytes beskytter din datamaskin Sikkerhet på internett har blitt mer kritisk enn noen gang. Med økende cybertrusler er et kraftig antivirusprogram ikke bare en

Alt du trenger å vite om Malware Zeus

Introduksjon til Malware Zeus Malware Zeus, også kjent som Zbot, er et stykke skadelig programvare designet for å stjele konfidensiell informasjon fra infiserte datamaskiner. Dens

Maksimer din digitale sikkerhet med Malwarebytes Premium

Introduksjon til Malwarebytes Premium Når det kommer til datamaskinens sikkerhet, er det essensielt å ha en robust løsning som kan beskytte mot de siste og

Rens opp i Macen: Hvordan Fjerne Malware Yahoo Search fra din MacBook

Introduksjon: Forstå Problemstillingen med Malware Yahoo Search på Mac Malware, eller ondsinnet programvare, infiserer ofte datamaskiner uten brukerens vitende. En vanlig problemstilling for Mac-brukere er

Veiledning til Malwarebytes på Windows 7: Sikkerhetsstyrking for Eldre Systemer

Introduksjon til Malwarebytes for Windows 7 I en tid der cybersikkerhet er mer kritisk enn noen gang, er det viktig for brukere av eldre operativsystemer,

Beskytt din WordPress-side mot Malware: En omfattende guide

Introduksjon til Malware i WordPress WordPress er en av de mest populære plattformene for nettsider verden over. Men dens popularitet gjør den også til et

Beskyttelse mot Malware på Windows 7: En komplett guide

Introduksjon til Malware Windows 7 Malware, en forkortelse for «malicious software», omfatter ulike typer skadelig programvare som virus, trojanere, spyware og ransomware. Selv om Windows

Full beskyttelse mot Malware Win32: En omfattende guide

Introduksjon til Malware Win32 Malware Win32 refererer til en kategori av ondsinnet programvare, eller malware, som er designet for å infisere eller skade datamaskiner som

Beskytt Deg mot Malware TrickBot – En Grundig Veiledning

Introduksjon til Malware TrickBot Malware TrickBot er en form for ondsinnet programvare som hovedsakelig brukes til å stjele finansiell informasjon. Siden dens opprinnelse rundt 2016

Beskytt Android-Enheten din mot Malware via Tor og Jack

Innledning til Malware, Tor, og Jack på Android I en verden stadig mer avhengig av mobile teknologier, er sikkerhet et kritisk område som krever oppmerksomhet.

Beskytt din Samsung-enhet mot malware: En komplett guide

Innledning til 'Malware Samsung'-problematikken I en verden der digital sikkerhet blir stadig viktigere, er det essensielt for enhver Samsung-bruker å være informert om truslene som

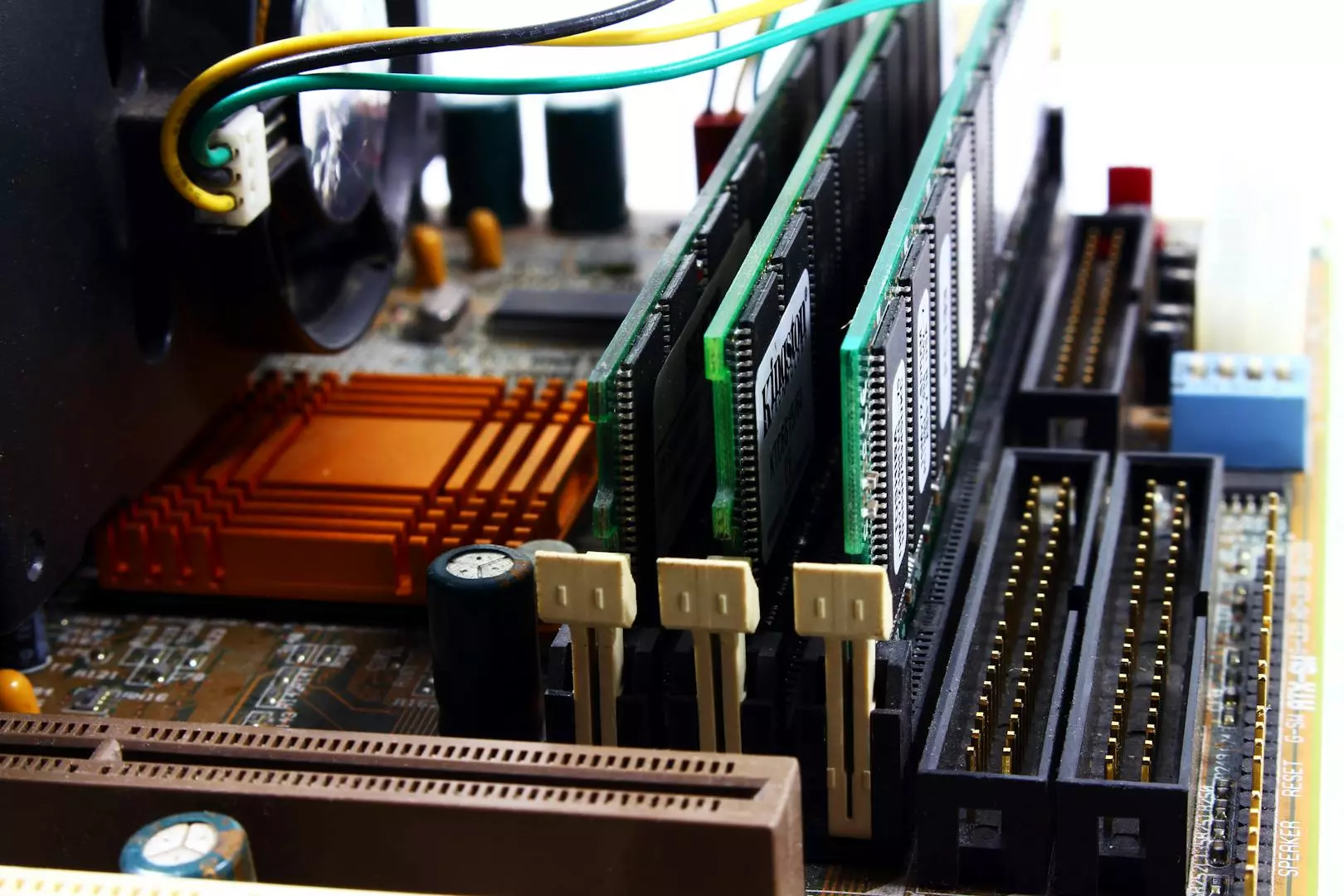

Beskyttelse mot Malware RAM: Alt du trenger å vite

Hva er Malware RAM? Malware RAM refererer til ondsinnet programvare som utnytter datamaskinens minne (RAM) for å utføre skadelige aktiviteter uten å etterlate spor på

Sikre din PC mot malware: En omfattende guide

Hva er Malware PC og hvordan påvirker det deg? Malware, eller skadelig programvare, refererer til alle typer programvare designet for å skade eller infiltrere en

Komplette Veiledninger til Malware Terminator: Beskytt Din Datamaskin Effektivt

Introduksjon til Malware Terminator I en tid hvor datavirus og skadelig programvare (malware) blir stadig mer avansert og skadelig, er behovet for effektiv beskyttelse kritisk.

Alt du trenger å vite om Malware på norsk

Hva er Malware? Forståelse av skadelig programvare på norsk Malware, eller skadelig programvare, refererer til ethvert program eller en fil som kan skade brukeren av

Alt du trenger å vite om Malware Mirai

Forstå Malware Mirai: En Innføring Malware Mirai er et av de mer kjente malware-programmene som har påvirket internettets sikkerhet drastisk. Denne typen skadevare ble først

Beskyttelse mot og fjerning av ‘Malware Portable’: En komplett guide

Hva er 'Malware Portable'? Malware, kort for skadelig programvare, refererer til enhver programvare utviklet for å skade eller utnytte ethvert programmerbart system eller nettverk. ‘Malware

Beskyttelse Mot Malware: En Guide til Microsofts Verktøy og Taktikker

Innledning til Malware Microsoft – en stadig trussel Cybersikkerhet er mer relevant enn noen gang, og med en økende mengde malware som truer både enkeltpersoner

Beskyttelse Mot Malware Panda: Vær Sikker på Nettet

Forstå Malware Panda: En Introduksjon Malware Panda er ikke bare navnet på et spesifikt skadelig program, men heller en kategori av malware som kan påføre

Beskytt ditt Linux-system mot malware

Introduksjon til malware på Linux Selv om mange tror at Linux-systemer er immune mot malware, er dette en vanlig misforståelse. Malware, eller ondsinnet programvare, kan

Beskytt din iPhone mot Malware: Essensielle Tips og Råd

Innledning til Malware på iPhone De fleste av oss er avhengige av våre smarttelefoner, og iPhone-brukere er intet unntak. Imidlertid, med økende avhengighet, følger også

Hvordan Beskytte Din Google Chrome på Android mot Malware

Innledning til Malware i Google Chrome på Android Google Chrome er en av de mest populære nettleserne på Android-enheter på grunn av dens høye ytelse

Beskytt Enheter mot Malware på Google Play: En Omfattende Guide

Hvordan Malware finner veien til Google Play Malware på Google Play representerer en betydelig trussel mot brukernes sikkerhet og privatliv. Dessverre, selv med strenge kontroller

Beskytt Din Firefox Mot Malware: En Komplett Guide

Forstå Malware og Dets Risikoer for Firefox Malware, en forkortelse for skadelig programvare, utgjør en signifikant trussel mot internettsikkerheten. Disse uønskede programmene kan infisere systemer,

Beskyttelse mot Fileless Malware: Det Usynlige Trussel

Introduksjon til Fileless Malware Fileless malware er en form for ondsinnet programvare som ikke etterlater tradisjonelle filspor på datamaskinen din, noe som gjør det ekstremt

Beskytt Digital Liv: En Grundig Gjennomgang av Malware Fighter 9.1

Introduksjon til Malware Fighter 9.1 I en verden der digital sikkerhet blir stadig viktigere, er behovet for robuste sikkerhetsløsninger tydeligere enn noen gang. Malware Fighter

Beskytt enheten din fra Malware Joker på Android: En omfattende guide

Introduksjon til Malware Joker Android Malware Joker er en av de mest påtrengende og skadelige programvarer som har påvirket Android-brukere de siste årene. Denne typen

Beskyttelse Mot Malware Full: En Komplett Guide

Introduksjon til Malware Full Malware, forkortelsen for malicious software, refererer til enhver programvare laget for å skade eller utnytte ethvert programmerbart system eller nettverk. Når

Beskytt Digital Livet Ditt: En Guide til Malware Fighter

Hva er Malware Fighter og Hvorfor Trenger Du Det Malware fighter er et viktig verktøy for alle som bruker internett. Programmet hjelper til med å

Beskytt deg mot Malware på Microsoft Edge

Introduksjon til Malware Edge-problematikken I dagens digitale tidsalder er trusselen fra skadelig programvare, eller malware, alltid til stede. Brukere av populære nettlesere som Microsoft Edge

Malware Download Gratis: Naviger Risikoene med Kunnskap

Introduksjon til Malware Download Gratis Når du søker etter gratis programvare på internett, kan du ofte komme over nettsteder som tilbyr malware download gratis. Selv

Maksimer din enhets sikkerhet med Malware Fighter 9

Introduksjon til Malware Fighter 9 I digitaliseringens tidsalder har trusselen fra uønsket og skadelig programvare, eller malware, aldri vært mer aktuell. Derfor er det essensielt

Detektering av Skadelig Programvare: En Omfattende Guide til Malware Detecter

Hva er Malware Detecter? Malware detecter refererer til programvare og verktøy designet for å identifisere, analysere og fjerne skadelig programvare fra datamaskiner og nettverk. Disse

Beskyttelse mot Malware DoS-angrep: Hvordan sikre dine digitale ressurser

Introduksjon til Malware DoS Den digitale verdenen er full av trusler, og en av de mest ødeleggende angrepene som kan ramme en organisasjon er malware

Beskytt Din Digitale Verden: En Guide til Malware Defender

Hva er Malware Defender? Malware Defender er en kraftig programvare som beskytter datamaskiner mot ulike typer skadelig programvare, alt fra virus og trojanere til spionprogrammer

Hvordan Identifisere og Fjerne Malware fra Chrome

Introduksjon til Malware Chrome-problematikken Nettsikkerhet er et stadig økende bekymringspunkt for mange internettbrukere. Spesielt er nettleseren Google Chrome, som er en av de mest brukte

Hvordan beskytte din enhet mot Malware på Chrome for Android

Introduksjon til Malware Risiko på Chrome for Android Malware, eller skadelig programvare, representerer en konstant trussel mot internettbrukere, inkludert de som bruker populære nettlesere som

Beskytt deg mot Malware i CCleaner: En Komplett Guide

Innledning til Malware i CCleaner I de siste årene har CCleaner, et populært verktøy designet for å rense opp i unødvendige filer på en datamaskin

Maksimer Beskyttelsen: En Full Gjennomgang av Malwarebytes

Introduksjon til Malwarebytes Malwarebytes er et anerkjent verktøy i kampen mot skadelig programvare. Det tilbyr omfattende beskyttelse mot virus, spyware, og andre trusler som kan

Beskytt Deg mot Malware Dialer: En Omfattende Guide

Hva er Malware Dialer? Malware/) dialer, ofte bare referert til som en dialer, er et type ondsinnet programvare (malware) designet for å ta kontroll over

En omfattende guide til Malware Bytes: Beskytt deg mot digitale trusler

Introduksjon til Malware Bytes Malware-mot-skadelig-programvare/), eller ondsinnet programvare, fortsetter å være en formidabel trussel mot både individuelle brukere og bedrifter. I en tid hvor dataangrep

Beskytt Din Digitale Verden: En Guide til Malware Avast

Introduksjon til Malware Avast I takt med at teknologien utvikler seg, blir også truslene mot vår sikkerhet mer avanserte. Derfor er det viktigere enn noen

Effektiv Beskyttelse med Malware AdwCleaner: En Komplett Guide

Innledning til Malware AdwCleaner Hvis du opplever forstyrrelser mens du bruker datamaskinen i form av uønskede annonser, verktøylinjer eller redirect-elendigheter, kan det hende du har

Alt du trenger å vite om Malwarebytes Portable

Introduksjon til Malwarebytes Portable I en verden hvor datasikkerhet blir stadig viktigere, er Malwarebytes Portable et verktøy du ikke vil være uten. Dette bærbare sikkerhetsprogrammet

Til kamp mot cybertrusler: En guide til Malware og Anti-Malware

Hva er Malware, og hvorfor trenger du Anti-Malware? Malware/), eller skadelig programvare, er enhver programvare formålslig designet for å skade eller utnytte enhver programmerbar enhet,

Beskyttelse Mot Malware Bits: Hvordan Sikre Din Digitale Verden

Introduksjon til Malware Bits Malware/), kort for malicious software, refererer til enhver programvare som er designet for å skade eller infiltrere en datamaskin uten brukerens

Malware 2022: Hvordan Beskytte Seg Mot Årets Trusler

Introduksjon til Malware 2022 Med teknologiens fremskritt, oppstår nye trusler. 2022 har ikke vært noe unntak, og malware (ondsinnet programvare) har fortsatt å være en

Alt du trenger å vite om Malware 0

Hva er Malware 0? Malware/) 0 refererer, ikke til en spesifikk type malware, men til en kategori av skadelig programvare designet for å infiltrere eller

Beskytt din Android-enhet mot skadelig programvare

Forståelse av Malware på Android-enheter Malware/), eller skadelig programvare, representerer et bredt spekter av programvare utformet for å skade, forstyrre eller få uautorisert tilgang til

Utforsk Verdenen av Maldet: En Omfattende Guide

Introduksjon til Maldet Maldet, ofte omtalt i tekniske kretser, er et verktøy som spiller en kritisk rolle i sikkerheten av våre digitale systemer. Dens primære

Hvordan fikse et lekk toalett: En komplett guide

Innledning Et lekk toalett kan være mer enn bare en irritasjon. Det representerer også en unødvendig økonomisk belastning på grunn av vannspill og kan føre

Hvordan Fikse Langsomme PC-er: En Trinnvis Guide

Introduksjon til problemet med langsomme PC-er Opplever du at din PC er blitt treigere over tid? Det er en vanlig utfordring mange står overfor. En

Slik kobler du TV-en din til internett

Introduksjon til å koble TV til internett I en verden hvor strømmetjenester og smart TV-apparater blir stadig mer populære, blir behovet for å koble TV-en

Koble til Internett med Kabel: En Enkel Guide

Introduksjon: Hvorfor velge kablet internettforbindelse? I en tid hvor trådløse forbindelser dominerer, kan det virke gammeldags å bruke en kabel-kabel-kobling/) for å koble til internett.

Beskytt Din Digitale Verden: En Guide til Å Forstå og Forebygge Malware

Hva Er Malware? En Grundig Forklaring Malware, en forkortelse for malicious software, refererer til enhver type programvare som er designet for å skade eller utføre

Koble Til Internett Med Altibox: Enkelt og Raskt

Introduksjon til [Koble til internett Altibox] I en verden hvor digital tilkobling er nøkkelen til både arbeid og fritid, er det viktig å ha et

Beskyttelse mot Linux Virus: En Omfattende Guide

Forstå Hva en Linux Virus Er Linux, kjent for sin sikkerhet og stabilitet, er ikke immun mot virus. Et Linux virus refererer til skadelig programvare

Utforskning av Kokkekunstens Historie

Introduksjon til Kokkekunstens Historie Kokkekunsten, ofte også kjent som kulinariske kunster, er en kunstform som uttrykker seg gjennom matlaging. Historien strekker seg over århundrer og

Koble Sony TV til Internett: En Steg-for-Steg Guide

Introduksjon til å koble Sony TV til internett Kobling av din Sony TV til internett åpner en helt ny verden av underholdningsmuligheter. Fra streaming av

Hvordan koble ruter til modem: En grundig guide

Steg-for-steg: Slik kobler du ruter til modem Forberedelser før du kobler ruter til modem Før du begynner arbeidet, er det viktig å sikre at du

Koble til Internett med Telenor: En trinnvis Guide

Hvordan forberede seg før du kobler til Internett med Telenor Før du starter prosessen med å koble til Internett, er det viktig å sørge for

Veiledning for å Koble til Internett: En Steg-for-Steg Guide

Hva du trenger å vite for å koble til internett Internett har blitt en uunnværlig del av hverdagen vår. Det er viktig både for profesjonell

Koble Ruter til Fibernett: En Trinnvis Guide

Introduksjon: Forberedelser for å koble ruter til fibernett Når man først får installert fibernett hjemme eller på kontoret, er neste skritt å koble til ruteren.

Slik kobler du RiksTV til internett – En trinnvis veiledning

Introduksjon til å koble RiksTV til internett Å koble-en-trinnvis-guide/) RiksTV-dekoderen til internett åpner en verden av muligheter. Fra strømming av TV-programmer til oppdaterte tjenester direkte

Koble Panasonic TV til Internett: En Trinnvis Guide

Inledning til å Koble Panasonic TV til Internett Før du begynner med selve tilkoblingsprosessen, er det viktig å sørge for at du har alt du

Koble Internett til TV: En Trinn-for-Trinn Guide

Hvorfor koble internett til din TV? I dagens digitale tidsalder er det flere og flere som finner verdien i å koble-en-trinnvis-guide/) internett direkte til TV-en.

Hvordan koble internett-kabel: En trinnvis guide

Forstå fordelene med å koble til internett via kabel Mange velger Wi-Fi for enkelhets skyld, men en kablet forbindelse kan ofte tilby både høyere hastigheter

Koble Smart TV Til Internett: En Trinn-for-Trinn Guide

Introduksjon Å koble-en-trinnvis-guide/) din Smart TV til internett åpner opp en verden av underholdningsmuligheter. Fra å strømme favorittseriene dine på Netflix til å surfe på

Koble Dekoder til Internett: En Trinnvis Guide

Introduksjon til å Koble Dekoder til Internett I en verden der digitalt innhold stadig blir mer sentralt i våre liv, er det viktig å sørge

Guide: Slik kobler du Canal Digital-dekoderen til internett trådløst

Innledning I en verden hvor underholdning er mer digitalisert enn noensinne, støtter Canal Digital en trådløs tilkobling for sin dekoder. Denne guiden forklarer hvordan du

Koble LG TV til Internett: En Trinn-for-Trinn Guide

Introduksjon til å koble LG TV til internett I en verden hvor alt blir mer og mer digitalisert, er det å ha en smart-TV koblet

Koble Apple TV til Delt Internett: En Trinn-for-Trinn Guide

Introduksjon Å koble en Apple TV til delt internett kan virke komplisert, men med riktig fremgangsmåte blir prosessen både enkel og smidig. Om du ønsker

Koble Apple TV til Trådløst Nett: En Trinn-for-Trinn Guide

Innledning: Hvordan Koble til Apple TV Trådløst I en verden der streaming tjenester blir stadig mer populære, har enheter som Apple TV blitt en essensiell

Koble Apple TV til Internett: En Enkel Guide

Innledning I en tid der strømmetjenester-musik-en-guide-til-moderne-lytteopplevelser/) og digital underholdning er sentrale i mange hjem, er det essensielt å koble enhetene våre riktig til Internett. Dette

Kjennskap til KMSPico Trojan: Hvordan Identifisere og Fjerne Skadelig Programvare

Introduksjon til KMSPico og assosierte risikoer KMSPico er kjent blant mange brukere som et verktøy for å aktivere Microsoft Windows og Office-produkter uten en gyldig

Koble Chromecast til internett: En trinn-for-trinn guide

Trinn 1: Pakk ut og koble Chromecast til TV Åpne Chromecast-pakken din og finn HDMI-enden av Chromecast-enheten. Plugg denne inn i en ledig HDMI-port på

Beskyttelse mot KMS Trojan: Forstå og bekjempe trusselen

Hva er KMS Trojan? KMS Trojan er et skadelig program, klassifisert som en trojaner, som ofte utgir seg for å være en del av en

Slik kobler du Flexit til Internett

Innledning: Forberedelser før du kobler Flexit til internett Flexit-ventilasjonssystemer er populære for sine avanserte funksjoner og muligheten til å forbedre inneluftskvaliteten i hjemmet. For å

Beskyttelse mot Killer Malware: En Komplett Guide

Forståelse av Killer Malware Killer-med-antivirus-trojan-killer/) malware er en type skadelig programvare designet for spesifikt å forårsake omfattende skade på systemer, stjele sensitiv informasjon, eller begge

Helhetlig Beskyttelse mot Keyloggere: Din Komplette Guide til Keylogger Antivirus

Introduksjon til Keylogger Antivirus Keyloggere er skjulte programmer som kan innhente og lagre hver tastetrykk du gjør. Dette kan inkludere passord, kredittkortinformasjon, og andre sensitive

Alt du trenger å vite om vaksiner for katten din

Hvorfor er vaksiner viktige for din katt? Vaksiner spiller en essensiell rolle i livet til din katt. De bidrar til å forebygge ulike sykdommer som

Komplett Guide til Beskyttelse Mot Kaspersky Trojan

Introduksjon til Kaspersky Trojan Trojanere representerer en form for skadelig programvare som ofte skjuler seg som legitim programvare. Kaspersky trojan refererer spesifikt til trojanere som

Beskyttelse Mot Malware: En Omfattende Guide til Kaspersky Malware Verktøy

Introduksjon til Kaspersky Malware Verktøy I en verden hvor digital sikkerhet stadig blir mer kritisk, er det viktig å velge riktig verktøy for å beskytte

Beskyttelse mot KMS Malware: Forstå og Bekjemp Trusselen

Intro til KMS Malware KMS Malware, eller Key Management Service-relatert skadevare, har blitt en økende bekymring for brukere over hele verden. Dette type angrep prøver

Alt du trenger å vite om Kaspersky Virus Tool

Introduksjon til Kaspersky Virus Tool I en verden preget av stadig økende digitale trusler, er det viktigere enn noen gang å beskytte dine digitale enheter.

Utforsk Delikatessen: En Reise Gjennom Italiensk Mat på Din Italiensk Mat Blogg

Velkommen til din italiensk mat blogg: Hva kan du forvente? Italiensk mat er ikke bare pizza og pasta, selv om disse rettene utvilsomt er blant

Beskyttelse mot Kaspersky CryptoLocker: En Guide til Forståelse og Forsvarsstrategier

Introduksjon til Kaspersky CryptoLocker Kaspersky/) CryptoLocker er en type skadelig programvare, eller malware, som går under kategorien ransomware. Den krypterer offerets filer og krever løsepenger

Beskytt PC-en Din Med IObit Malware Fighter 10

Introduksjon til IObit Malware Fighter 10 IObit Malware-mot-skadelig-programvare/) Fighter 10 er den nyeste utgaven av IObits populære antivirus- og antimalwareprogram. Oppgraderinger og forbedringer i denne

Beskytt Din Digitale Verden med Kaspersky Anti-Malware

Introduksjon til Kaspersky Anti-Malware Når det kommer til å sikre dine digitale enheter, er Kaspersky Anti-Malware blant de fremste valgene for mange brukere rundt om

Hvordan og Hvorfor Vaksinere Din Hund: En Dyptgående Guide

Innledning til temaet hund vaksine Å vaksinere hunden din er en av de mest effektive måtene å sikre helsen og velværet til ditt kjære kjæledyr.

Alt du Trenger å Vite om Internett Kabel Kobling

Grunnleggende Informasjon om Internett Kabel Kobling Internett er blitt en uunnværlig del av våre liv, og kvaliteten på vår nettforbindelse påvirker alt fra hjemmearbeid til

En Omfattende Guide til IObit Mal: Sikre og Optimaliser Din PC

Hva er IObit Mal? En Introduksjon IObit Mal, et kjent verktøy blant PC-brukere, er designet for å beskytte og optimalisere datamaskiner. Dette programmet tilbyr en

Hva er kokkekunst? En dypdykk inn i kokekunstens verden

Innledning til kokkekunst Kokkekunst, eller det å lage mat, er mer enn bare det å forberede måltider. Det er en omfattende kreativ praksis som kombinerer

Hjelp til PC: En Guide for Nybegynnere og Viderekommende

Grunnleggende trinn for feilsøking – Hjelp til PC Før du kontakter en teknisk ekspert eller bruker penger på reparasjoner, er det noen grunnleggende trinn du

Hjelp med PC: En Gjennomgang for Nybegynnere og Erfarne Brukere

Introduksjon til Hjelp med PC Å ha en PC er nesten essensielt i den digitale tidsalderen. Den kan brukes til alt fra arbeid og studier

Hvordan fikse et Ifø toalett som lekker

Innledning: Er ditt Ifø toalett som lekker? Å oppdage at toalettet lekker kan være frustrerende. Det kan føre til vannskader, høyere vannregninger og unødvendig stress

Hvordan Bruke HitmanPro Virus for Å Beskytte Din Datamaskin

Innledning til HitmanPro Virus HitmanPro er et kraftig verktøy designet for å bekjempe skadelig programvare og virus som har infisert din datamaskin. Det er kjent

Hvordan Beskytte PC-en din med HitmanPro Malware

Introduksjon til HitmanPro Malware I en verden der digital sikkerhet stadig blir mer kritisk, er behovet for effektive antivirus- og antimalware-programmer mer essensielt enn noensinne.

Herdprotect: Din ultimate veiviser til digital sikkerhet og beskyttelse

Introduksjon til Herdprotect I en verden hvor digital sikkerhet blir stadig mer kritisk, er det essensielt å ha pålitelige verktøy som kan beskytte våre enheter,

Hva Er Et Helseforetak? En Komplett Guide

Introduksjon til helseforetak I tiden hvor helse og velvære står sentralt i samfunnsdebatten, er forståelsen av hva et helseforetak faktisk er, blitt mer avgjørende enn

Hvordan Fikse et Gustavsberg Toalett som Lekker

Årsaker til at et Gustavsberg Toalett Kan Lekke Å oppdage at toalettet lekker kan være frustrerende. For å løse problemet effektivt, må man først forstå

Alt du trenger å vite om Gridinsoft Trojan Killer Portable

Introduksjon til Gridinsoft Trojan Killer Portable Gridinsoft Trojan Killer Portable er et kraftig verktøy designet for å oppdage og eliminere trojanere og andre skadelige programmer

Kom i Gang med Hemit Hjelp: Din Guide til Effektiv Brukerstøtte

Introduksjon til Hemit Hjelp Hemit står for helse Midt-Norges IT, og det spiller en kritisk rolle for IT-systemene i helseforetakene i Midt-Norge. På grunn av

En omfattende guide til HitmanPro Scan: Slik beskytter du datamaskinen din effektivt

Innledning til HitmanPro Scan HitmanPro er et kraftig verktøy for de som ønsker å holde datamaskinen sin sikker fra malware, spyware, og andre trusler. Denne

Beskytt Din PC mot Skadeware med GridinSoft Trojan Killer

Hvordan GridinSoft Trojan Killer beskytter mot Malware og Trojanske Hester GridinSoft-4-2/) Trojan Killer er et effektivt verktøy til bekjempelse av malware og trojanske hester som

Utforsk Gridinsoft Free: Din Guide til Gratis Sikkerhetsløsninger

Introduksjon til Gridinsoft Free Å holde datamaskinen, personlige opplysninger og data sikre kan være en stor bekymring for mange. Heldigvis tilbyr Gridinsoft løsninger som kan

Beskytt Din PC Effektivt Med GridinSoft Malware

Hva er GridinSoft Malware? GridinSoft Malware, et kraftig verktøy dedikert til å bekjempe ondsinnede programmer og filer, tilbyr en robust løsning for brukere som ønsker

GridinSoft Portable: En Veiledning til Effektiv Sikkerhet på Farten

Introduksjon til GridinSoft Portable GridinSoft Portable-free-portable-losninger/) er et kraftfullt verktøy designet for å hjelpe brukere med å bekjempe ulike former for malware, adware og andre

En Omfattende Gjennomgang av GridinSoft Anti-Malware 4.2.56

Introduksjon til GridinSoft Anti-Malware 4.2.56 I en verden dominert av stadig skiftende cybertrusler, blir beskyttelse av våre digitale enheter stadig viktigere. GridinSoft Anti-Malware 4.2.56 fremstår

Guide til Gridinsoft Anti Malware Portable: Ditt Mobile Beskyttelsesverktøy

Introduksjon til Gridinsoft Anti Malware Portable Gridinsoft Anti-programmer/) Malware Portable har vokst fram som et essensielt verktøy for de som trenger robust beskyttelse mot malware,

Alt du trenger å vite om Gridinsoft Anti-Malware 2022

Introduksjon til Gridinsoft Anti-Malware 2022 I en verden hvor digital sikkerhet blir stadig viktigere, har behovet for effektive anti-malware løsninger aldri vært større. Gridinsoft Anti-Malware

Effektiv Beskyttelse mot Malware: En Guide til Gridinsoft Anti-Malware

Introduksjon til Gridinsoft Anti-Malware I en verden hvor cybertrusler konstant utvikler seg, er det avgjørende å holde datamaskinene sikre. Gridinsoft Anti-Malware er et verktøy designet

En Omfattende Gjennomgang av GridinSoft Anti-Malware 4.2.21

Introduksjon til GridinSoft Anti-Malware 4.2.21 I en tid der digital sikkerhet er mer kritisk enn noensinne, er det essensielt å ha pålitelig programvare som beskytter

En omfattende guide til GridinSoft: Sikkerhetsverktøy du kan stole på

Introduksjon til GridinSoft GridinSoft er et anerkjent navn innen cybersikkerhetsverdenen, spesielt kjent for sin effektive og brukervennlige antivirus- og antimalware-løsninger. Selskapet har vært aktivt i

Gensere Vinter: En Guide til Varme og Stil

Finn den perfekte genseren for vinteren Når kuldegradene kryper innpå, er det essensielt å holde seg varm og komfortabel. Men hvem sier at du ikke

Utforsk Sikkerhetsløsninger med Gridinsoft Anti-Malware

Introduksjon til Gridinsoft Anti-Malware I dagens digitale alder er cybersikkerhet-mot-skadelig-programvare-en-guide-til-anti-mal/) viktigere enn noen gang. Gridinsoft Anti-Malware er designet for å tilby robust beskyttelse mot malware,

Alt du trenger å vite om GridinSoft Anti-Malware 4.2

Introduksjon til GridinSoft Anti-Malware 4.2 GridinSoft Anti-Malware 4.2 er skreddersydd for å beskytte datamaskinen din mot en rekke malware-trusler, inkludert virus, trojanere, og spyware. Denne

Alt du trenger å vite om Galileo PC Virus

Introduksjon til Galileo PC Virus Datavirus har i lang tid vært en trussel mot datasikkerheten. Et slikt virus, Galileo PC Virus, har vist seg å

Alt du trenger å vite om Galileo Virus på PC

Innledning: Forstå Galileo Virus på PC Galileo virus er et samlebegrep som ofte brukes for å beskrive en type skadevare, som kan infisere datamaskiner og

Beskytt Android-Enheten din mot Google Virus

Hva er Google Virus Android? Google virus er en samlebetegnelse som brukes for å beskrive en rekke skadelige programvarer og virus som rammer Android-enheter gjennom

Første vaksine for katten: Alt du trenger å vite

Innledning til første vaksine for katten Når du tar et nytt kjæledyr inn i hjemmet ditt, spesielt en katt, er en av de første og

Optimaliser Fraktkostnadene med Posten: En Grundig Guide

Hva påvirker fraktkostnadene ved Posten? Når du sender en pakke, er det flere faktorer som spiller inn på fraktkostnadene hos Posten. Disse inkluderer pakkenens størrelse,

Alt du trenger å vite om fraktkostnader hos IKEA

Innledning: Forstå fraktkostnader hos IKEA Når du handler hos IKEA, enten det er online eller i butikk, kan det dukke opp spørsmål om fraktkostnader. Det

Effektive Metoder for Å Redusere Fraktkostnader i Din Bedrift

Forstå Fraktkostnader: En Innledende Oversikt Fraktkostnader kan være en betydelig utgift for mange bedrifter, spesielt for de som ofte sender varer til nasjonale eller internasjonale

Fossilt Brensel Definisjon: En Dypdykking i Energikildenes Eldgamle Historikk

Introduksjon til Fossilt Brensel Definisjon Fossile brensler er kanskje et begrep vi ofte hører, men hva innebærer det egentlig? Disse energikildene har drevet moderne sivilisasjon

Fossilt Brensel: Livsnerven i Moderne Energi og Dets Konsekvenser

Hva er fossilt brensel? Fossilt brensel, som inkluderer kull, olje og naturgass, er energikilder som har blitt dannet av restene av døde planter og dyr

Fossilt Brennstoff Definisjon: En Grundig Forklaring

Hva Er Fossilt Brennstoff? En Definitiv Definisjon Fossilt brennstoff, en fellesbetegnelse som omfatter materialer som kull, olje og naturgass, utgjør en fundamental del av verdens

Fossilt brennstoff: En dypdykk inn i vår energihistorikk og fremtidige utfordringer

Innledning til fossilt brennstoff Fossile brennstoffer, inkludert olje, kull, og naturgass, har vært ryggraden i global energiforsyning i flere århundrer. Disse energikildene er dannet fra

Fossile Brensler: Vår Tidslinje og Framtid

Hva er fossile brensler? Fossile brensler, som inkluderer kull, olje og naturgass, er energikilder som har blitt dannet under jordens overflate over millioner av år

Fossil Brensel: Forståelse og Framtidsutsikter

Innledning til Fossil Brensel Fossil brensel er energikilder som har vært en bærebjelke i det globale energioppsettet i flere tiår. Disse brenselskildene, som inkluderer kull,

Fjerne virus på PC: En praktisk guide

Hva innebærer det å fjerne virus på PC? Datavirus kan være en stor trussel mot både personlig sikkerhet og datamaskinens funksjonalitet. Et virus kan ikke

Fjerne Virus på Android: En Komplett Guide

Hvordan identifisere et virus på din Android-enhet? Sikkerheten på din Android-enhet kan være kompromittert av ulike typer skadelig programvare, inkludert virus. Det første steget for

Fjerne Virus fra PC: En Komplett Guide

Introduksjon til å Fjerne Virus fra PC Viruser kan være en stor trussel mot datamaskinens ytelse og sikkerhet. De kan stjele personlig informasjon, skade filer

Fjerne malware: En komplett guide for sikker og effektiv sanering av datamaskiner

Hva er malware, og hvordan kan du identifisere det? Malware, eller skadelig programvare, refererer til ethvert program eller fil designet for å skade eller infiltrere

En dypdykkende utforskning av Fileless-angrep: Hva du trenger å vite

Hva er Fileless-angrep og hvorfor bør du bry deg? Fileless-angrep, også kjent som non-malware-angrep, er en sofistikert type cyberangrep hvor hackere utnytter eksisterende programvare, tillatt

Eset SysRescue Live ISO: En Grundig Guide

Introduksjon til Eset SysRescue Live ISO Eset SysRescue Live ISO er et kraftig verktøy for de som ønsker å reparere og gjenopprette systemer som er

Beskytt Dine Digitale Enheter: Fullstendig Guide til ESET Malware Løsninger

Forstå ESET Malware Beskyttelse I en tid der cybertrusler stadig utvikler seg, er det essensielt å sørge for at dine digitale enheter er godt beskyttet.

Ett Års Vaksine Hund: En Guide til Din Hundes Helse

Introduksjon til ett års vaksine for hunder Når hundene våre nærmer seg sitt første leveår, er det viktig å vurdere vaksinasjoner for å beskytte dem

Beskytt Deg mot Eset Keylogger: Viktige Tips og Teknikker

Introduksjon til Eset Keylogger Keyloggers, et type skadelig programvare designet for å registrere tastetrykkene du utfører på tastaturet ditt, kan være en alvorlig trussel mot

Optimal sikkerhet på din gamle PC: Emsisoft og Windows 7

Introduksjon til Emsisoft for Windows 7 Windows 7, en gang i tiden en av de mest populære operativsystemene fra Microsoft, mottar ikke lenger offisiell støtte

Emsisoft Kit: Din Guide til Effektiv Virusbeskyttelse

Introduksjon til Emsisoft Kit I en verden som blir stadig mer digitalisert, er cybersikkerhet-mot-skadelig-programvare-en-guide-til-anti-mal/) et avgjørende fokusområde for både individer og bedrifter. Emsisoft-fra-emsisoft/) Kit tilbyr

Beskytt Din Digitale Verden med Emsisoft Internet Security

Introduksjon til Emsisoft Internet Security I en verden hvor digital sikkerhet er mer kritisk enn noen gang, står mange forbrukere og bedrifter overfor det daglige

En Grundig Gjennomgang av Emsisoft Emergency Kit Free

Introduksjon til Emsisoft Emergency Kit Free Emsisoft–kit-fra-emsisoft/) Emergency Kit Free er et kraftig verktøy designet for å skanne og rense infiserte datamaskiner fra malware, uten

Fullstendig Guide til Emsisoft Full: Sikkerhetsløsninger for Ditt Digitale Liv

Introduksjon til Emsisoft Full Velkommen til en grundig gjennomgang av Emsisoft Full, en omfattende sikkerhetspakke designet for å beskytte datamaskiner og mobile enheter mot et

Beskytt Din Datamaskin mot EMP DLL Virus

Introduksjon til EMP DLL Virus I en digital tidsalder hvor sikkerheten til våre personlige data stadig utfordres, er det essensielt å holde seg oppdatert om

Beskytt Deg mot EMP DLL Trojan: En Omfattende Guide

Hva er EMP DLL Trojan? EMP DLL Trojan er en type skadelig programvare som har evnen til å infiltrere datamaskinsystemer på en svært skjult måte.

Sikker på farten: En guide til Emsisoft Anti-Malware Portable

Hva er Emsisoft Anti-Malware Portable? Emsisoft Anti-Malware Portable tilbyr en robust løsning for brukere som ønsker å beskytte sine bærbare enheter mot malware og andre

Alt du Trenger å Vite om Elkjøp PC Hjelp

Introduksjon til Elkjøp PC Hjelp Å håndtere tekniske problemer på egen hånd kan være en utfordrende oppgave. Heldigvis, hvis du har kjøpt en datamaskin fra

Beskytt Datamaskinen Din Effektivt med Emsisoft Anti-Malware

Hva er Emsisoft Anti-Malware? Emsisoft Anti-Malware er en avansert sikkerhetsløsning designet for å beskytte din PC mot en rekke trusler som virus, trojanere, spyware, adware,

Alt du trenger å vite om Emergency Kit fra Emsisoft

Introduksjon til Emergency Kit fra Emsisoft Emergency Kit fra Emsisoft er en uunnværlig samling verktøy designet for å analysere og rense infiserte datamaskiner, uten at

Alt du Trenger å Vite om Elbilbatterier

Introduksjon til Elbilbatterier Elbilbatterier representerer hjertet i hver elektriske bil. Uten dem, ingen fremdrift. Men hva er egentlig elbilbatterier, og hvordan fungerer de? I denne

Alt du trenger å vite om elbilbatteriet

Introduksjon til elbilbatteriet Elbilbatteriet er hjertet i enhver elektrisk bil. Det er denne komponenten som lagrer den elektriske energien som driver bilens motor. Med den

Alt du trenger å vite om elbil batterier

Introduksjon til elbil batterier Elbil batterier, også kjent som lithium-ion batterier, er hjertet av en elektrisk bil. Uten disse kraftpakkene, ville ikke elbiler kunne tilby

Alt du trenger å vite om elbil batteri volt

Forståelse av elbil batteri volt Elbil batteri volt refererer til den elektriske spenningen som batteriet i en elbil leverer. Denne spenningen er avgjørende for bilens

Alt du trenger å vite om elbil-batteriet

Hva er et elbil-batteri? Elbil-batteriet, også kjent som traksjonsbatteriet, er hjertet i hver elektrisk bil. Det lagrer den elektriske energien som kreves for å drive

Alt du trenger å vite om elbilbatterier

Introduksjon til elbilbatterier Elbilbatterier er hjertet i alle elektriske kjøretøy; de ikke bare lagrer energi som gjør at bilen kan kjøre, men spiller også en

Dusjkabinett for Eldre: En Guide til Trygg og Komfortabel Dusjing